Embarking on the path to compliance is no easy feat, and small businesses often find themselves navigating this complex terrain completely blindfolded or tempted to take shortcuts. Big mistake!

In this guide, we uncover the 7 Deadly Sins of Compliance, shedding light on common compliance mistakes that can jeopardize your business's security and reputation. We'll explore each mistake and provide insights on how to steer clear of these pitfalls.

Let us be your guardian angel and join us on this journey as we decode the intricacies of compliance, ensuring you're well-equipped to navigate the ever-evolving landscape of regulatory requirements:

- Skipping the Internal Audit Process

- Badge Hunting

- Neglecting Vendor Compliance Reports

- Not Leveraging Compliance Automation Software

- Lacking a Compliance Culture

- Focusing on Getting Compliant and not on Staying Compliant

- Going Solo: Not Asking for Help

Skipping the Internal Audit Process

An internal audit offers a unique opportunity for preparation and serves as a mock exam or practice run for the external compliance journey. It familiarizes your organization with the compliance requirements and expectations, ensuring a smoother transition to the external audit.

Additionally, the internal audit provides valuable insights into the effectiveness of existing policies and controls, helping not just compliance preparedness, but also revealing your security posture and ways to improve it.

Skipping this step is like going into the external audit blind, which might lead to costly surprises later, as addressing compliance issues during the external audit tends to be more expensive than resolving them internally.

Don't gamble; do that internal audit first!

Badge Hunting

Listen to our experts! You must carefully consider which compliance framework to pursue rather than choosing one randomly for the sake of it. Selecting a compliance framework without thoughtful consideration can lead to inefficient processes, wasted resources, and potentially missing the mark on actual compliance needs.

Different industries and business types often have specific compliance requirements. Choosing a framework at random may result in adopting standards that aren't directly applicable to your operations or are not what your customers are expecting.

For example, if you do business internationally, you will benefit from being ISO-27001 certified. But if you don’t do business with customers outside of the country, then SOC 2 may be a better solution for your company.

Furthermore, implementing a framework without considering your business's resources can result in unnecessary expenses and strain on your budget. Compliance efforts demand a substantial investment of time, money, and manpower, requiring a clear understanding of your willingness and capability to commit. Choosing the appropriate framework ensures that resources are utilized efficiently.

To illustrate, if your business is confined to the U.S., SOC 2 might be the preferred choice over ISO-27001. So far so good, however, determining whether to pursue a Type 1 or Type 2 audit depends on a combination of your goals, cost considerations, and timeline constraints.

A SOC 2 Type 2 audit involves more testing and documentation, making it more time-consuming and costly. If you’re facing contractual requirements for a SOC 2 report but lacking the time or resources for a Type 2 report, a SOC 2 Type 1 report becomes a viable solution. It helps meet the minimum requirement while buying time to plan for a Type 2 report in the future, providing a strategic approach to compliance in alignment with business capabilities.

As you can see, there needs to be some planning before picking which framework to go after. If you need guidance or support, don't hesitate to contact our expert team.

We're here to assist you every step of the way, ensuring you make informed choices and navigate the complexities of compliance with confidence. You can trust that you're in good hands with BEMO.

Neglecting Vendor Compliance Reports

While this mistake is not directly related to one of the steps on your compliance audit journey, it is worth mentioning in our "7 Deadly Sins of Compliance."

Your internal processes might be a fortress, but what about your vendors? Without a comprehensive examination of compliance reports, you may remain unaware of the security measures implemented by third parties handling your data.

Neglecting this step could leave you exposed if a vendor slips up, putting your reputation and compliance at risk. It’s shockingly common: cybercriminals are well aware of these gaps and target unprotected suppliers as gateways to get their hands on bigger organizations (read about it here).

Ensuring vendor compliance isn't just a matter of obtaining their compliance attestation. Firstly, it's crucial to confirm that the attestation aligns with the relevant framework (remember the last sin?). Secondly, the attestation must be up-to-date. Audits are typically conducted annually for a reason; a lot can change in 365 days.

Failing to ensure that your vendors adhere to industry-specific regulations may result in legal consequences, fines, and penalties for both the vendor and your SMB. On top of that, the aftermath of a third-party breach can disrupt your day-to-day operations, leading to operational downtime, loss of critical data, and the need for extensive investigations.

If you want to understand how to review your vendor’s SOC 2 Report, we provide all the juicy details in our article. Just click here. Follow our step-by-step guide and interpretation of each “chapter” of a SOC 2 report so you don't get lost in the process and can make better-informed business relationships.

(Stay tuned for future posts on how to review other frameworks’ reports.)

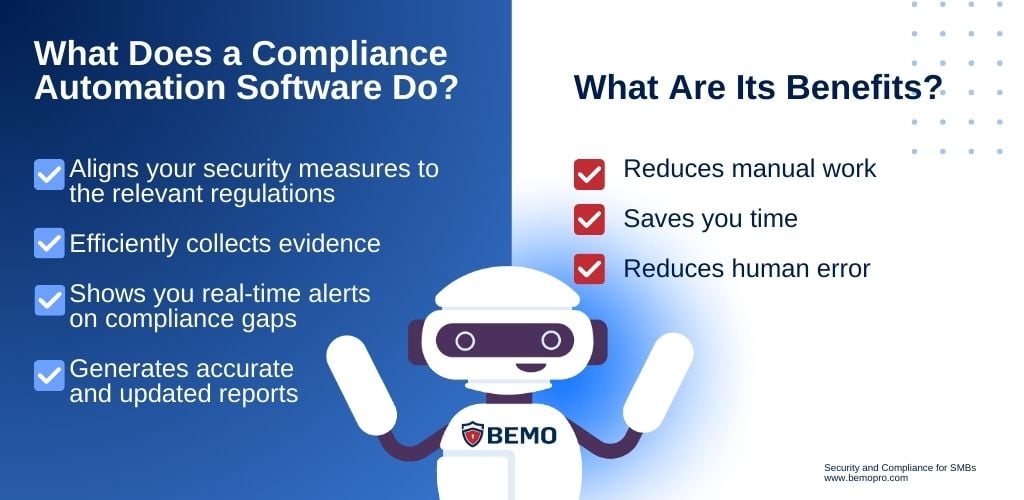

Not Leveraging Compliance Automation Software

Compliance is a marathon, not a sprint. Don't exhaust yourself with manual tasks!

You might underestimate the time and care it takes to properly collect and register all the documentation needed to prove the evidence of your security measures for the correct standards and regulations.

Compliance Automation Software streamlines this process, generating comprehensive reports, issuing real-time alerts, and notifying you of any compliance gaps or potential issues. These are aspects that manual efforts might overlook.

Automation not only expedites the compliance journey, but it also enhances accuracy. It gets your business to address potential pitfalls, saving time and resources while maintaining a robust and error-free compliance posture.

Lacking a Compliance Culture

Even the best policies are useless if your team doesn't understand them and know them. Unawareness leads to unintentional non-compliance and potential chaos. Invest in training programs to build a compliance culture year-round, not just when the audit is around the corner.

Conduct meetings to discuss compliance plans, new policies, and any updates to existing protocols. These gatherings provide a platform for open communication, allowing employees to ask questions, seek clarification on any uncertainties, or provide feedback and ideas to implement.

Additionally, supplement these meetings with comprehensive learning materials, ensuring that your team has access to resources that aid in understanding complex compliance concepts.

Provide easy access to policy documents, creating a centralized repository for employees to refer to when needed. This not only fosters transparency but also empowers your workforce to take swift and informed actions if something suspicious or non-compliant arises

Remember, a well-prepared team is your first line of defense against compliance mishaps!

Focusing on Getting Compliant not on Staying Compliant

Getting compliant is just the beginning; staying compliant is the real game-changer. Any compliance framework is not a one-time achievement but a continuous effort. Certification entities want to know you're in it for the long haul, and so do your customers!

As we mentioned earlier, an outdated report is of no use. Over a year, you change, the industry advances, and cybercriminals also evolve. Therefore, you need to stick to your security measures, continuously test them, and stay up to date with requirements and advanced threat protection solutions.

Plus, the first time is always the trickiest. Attaining your first compliance attestation or certification makes it easier to prepare for others.

Going Solo: Not Asking for Help

There are professionals who can help you with compliance, just like you would hire an accountant or a lawyer for other aspects of your business. Think of compliance as an investment, not a burden.

You're not alone in this compliance adventure. Small businesses might not have a dedicated compliance team, and that's okay. If you're feeling lost, reach out for help. Compliance providers exist for a reason.

Just remember to slice your goal into bite-sized pieces, don't skip any steps in the process, and if you feel like it’s more than you can handle, there's absolutely no shame in seeking some support. An extra set of hands can make the journey smoother.

Hit up our compliance experts here. If you book a meeting with us (or any other compliance provider) you’ll find these must-ask questions to ask a compliance provider very useful.

Final Thoughts

And there you go – the Compliance 7 Deadly Sins, all decoded just for you. Navigating compliance doesn't have to become a cyber-hell; after all, it's in your organization’s best interest.

Avoid these common mistakes, don't underestimate the importance of compliance, and let's build a business that can weather any storm.

Not sure which compliance you need in the future? BEMO Platinum & Managed IT will get your organization ready for any compliance you decide to go after. Schedule a meeting with one of our experts or click here to check out our Platinum Solution.

Why not make compliance your ally instead of an adversary on this entrepreneurial journey? 🚀

If you have questions or comments, leave your message in the comment section below.

If you find this article useful, share it with your community by hitting the LinkedIn share button, and don’t forget to tag us!

Top 10 Posts

-

Windows 10 Pro vs Enterprise

-

Migrate From Gmail to Office 365: Step-By-Step Guide

-

Windows 10 Enterprise E3 vs E5: What's the Difference?

-

What are the 4 types of Microsoft Active Directory?

-

How to Migrate from GoDaddy to Office 365

-

Google Workspace to Office 365 Migration: A Step-by-Step Guide

-

How to Set Up Office 365 Advanced Threat Protection

-

10 Benefits of Microsoft Teams

-

Top 3 Reasons to Move From Google Drive to Microsoft OneDrive

-

How to remove Office 365 from GoDaddy (tips and tricks)

-2.png?width=1080&height=1080&name=Untitled%20design%20(5)-2.png)

Leave us a comment!