We can compare an internal audit for a company to an annual health checkup. Even if you feel just fine, your doctor will tell you it is wise to go through some examination to verify your health status.

Similarly, a company might seem to be running smoothly, but only an internal review of its operations will guarantee it.

Just as a health check can save lives by identifying and addressing unforeseen health risks in their early, treatable stages, by conducting regular internal audits, a company can proactively address weaknesses and inefficiencies. This prevents issues from escalating and reaching a critical stage.

In this article we will explore the concept of internal audits, their significance, and the steps involved in an internal audit process.

Please keep in mind that there are several types of internal audits (operational, financial, etc.), we will focus on internal compliance audits.

What is an Internal Audit

An internal audit is a self-assessment conducted by an internal audit team within the organization to review the enterprise’s internal controls and compliance programs. Like an X-ray, it allows you to look past the surface, and sheds light on your company’s overall health status.

Evaluating and understanding what is happening inside your organization helps leadership in strategically allocating resources, minimizing undesired outcomes, and improving the company's ability to achieve its business objectives.

In the specific case of a compliance internal audit, think of it as a practice test, an opportunity to evaluate your knowledge, identify any gaps, and make improvements before facing the actual final exam – your audit.

While compliance isn't a pass or fail situation (the auditor provides an opinion ranging from clean to adverse), with team effort, you can work towards perfecting your policies and controls so that there are no negative exceptions found during the audit.

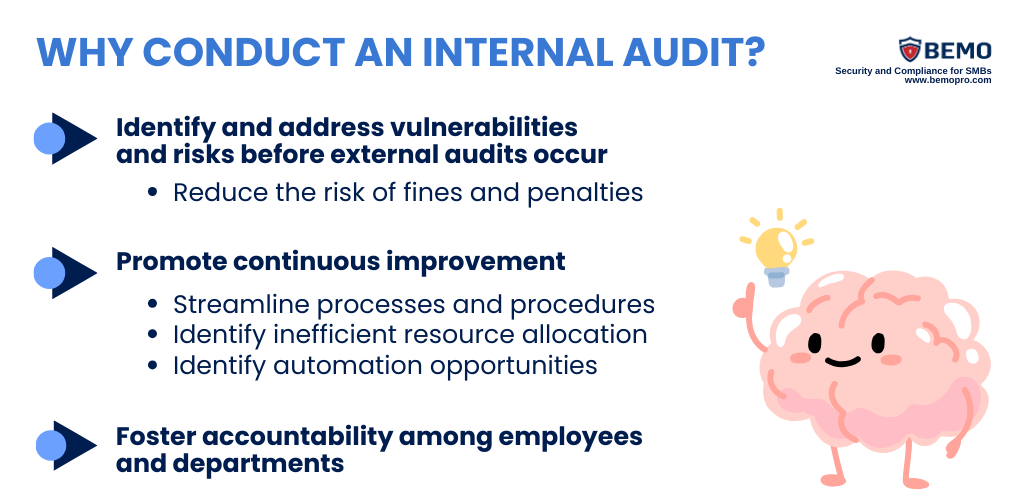

Why Internal Audits are Important

As we’ve stated, the main significance of internal audits lies in their ability to identify and address issues before external audits occur. Not only is it a good habit, but it’s also a smart financial move.

How exactly? Look at it this way: if a third-party auditor discovers a significant issue in your availability, confidentiality, security, privacy, or processing integrity controls during the audit, the consequences may include fines, legal fees, and business disruption.

Moreover, the urgency to address the issues to comply with external regulations may lead to rushed and more expensive solutions.

On the other hand, if you identify control errors during an internal audit, there's no major harm done – your organization has the time and flexibility to rectify them in a controlled environment and find the best solution at a reasonable price.

In addition, internal audits promote a culture of accountability and transparency within organizations. Systematic risk assessments conducted through these audits help management identify automation opportunities, innovative ways to streamline workflows, prioritize potential risks, and guarantee that they are not being overlooked.

Steps to Conduct an Internal Audit

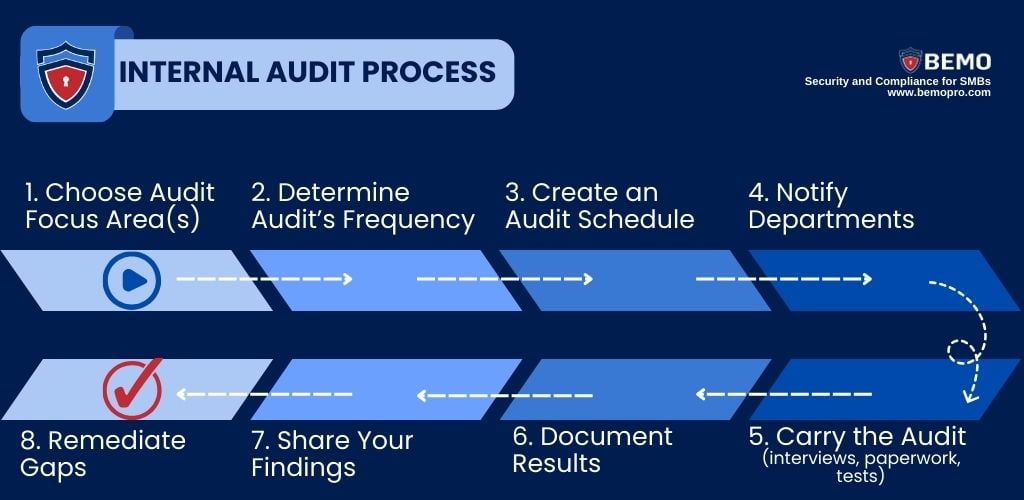

So far, we’ve covered questions like, “what is an internal audit?” and “how does it benefit your overall business operations?” It’s time to tackle the internal audit process and explain to you exactly how to conduct an internal audit.

-

Identify Areas for Auditing: make a list of the departments involved around the criteria you want to audit. For example, if you are preparing for an SOC 2 audit, you need to choose which Trust Services Criteria (TSC) you want to evaluate.

Focus only on the chosen criteria to optimize your efforts and not waste time documenting unrelated material. Consider all the areas that deploy the controls and policies that need to be audited and identify the activities they are responsible for.

-

Determine Frequency: Each department has its own structure and controls. Therefore, establish the frequency of audits for each department.

Some might need to be evaluated every quarter, others annually. Make sure you talk to each department’s leadership members to establish how often they need to be evaluated.

-

Create an Audit Calendar: Develop a detailed audit calendar for the year, outlining the schedule for each internal audit.

-

Alert Departments: You don’t want your employees to feel threatened by internal audits;, notify leadership and the relevant departments both the purpose of the audit and the scheduled dates.

This will promote transparency and cooperation and will give your teams the time to gather documents and necessary information. -

Execute the Audit: once everyone is onboard, review the documentation and processes. Conduct interviews with employees to gain insights into their work processes compared to written policies.

-

Document Results and Observations: Record the outcomes of the internal audit, highlighting any critical issues or areas needing improvement.

-

Report Findings: Prepare an easily understandable final report and share it with the personnel involved during the audit. Make sure to set up a review session with senior management, where you’ll talk about developing an action plan for improvement and, addressing any compliance gaps identified.

-

Remediate Identified Gaps: After the audit, take prompt action to remediate any gaps identified during the process, to ensure continuous improvement.

Wrap Up

In conclusion, internal audits serve as preventive medicine for your business, ensuring its overall health and resilience. You can identify potential issues before they evolve into critical problems, saving you from the financial and operational disruptions that adverse external audits might bring.

Additionally, the culture of accountability and transparency fostered by internal audits empowers your organization to proactively address weaknesses and streamline processes.

Navigating the complexities of internal audits can be challenging, especially when you might not even know where to begin assessing the state of your internal controls and policies. This is where partnering with experts like BEMO becomes a strategic move.

In a rapidly evolving landscape, understanding the intricacies of Microsoft security and staying updated with the latest advancements can be daunting.

With BEMO's cybersecurity solutions, you can focus on your core business activities while our experts handle the research, validation, and deployment of these updates. This ensures that your defenses are robust and ready to face any internal audit.

Take the first step towards a secure and compliant future – partner with BEMO and let us be your guide!

Top 10 Posts

-

Google Workspace to Office 365 Migration: A Step-by-Step Guide

-

Office 365 MFA Setup: Step-by-Step Instructions

-

How to Migrate from GoDaddy to Office 365

-

Migrate From Gmail to Office 365: 2024 Guide

-

CMMC Meaning : A Comprehensive Guide for Startups

-

How to remove Office 365 from GoDaddy (tips and tricks)

-

What is Microsoft Purview ? Your A to Z Guide to Getting Secure Fast

-

What is The CIA Triad?

-

How to Set Up Office Message Encryption (OME)

-

What are the 4 types of Microsoft Active Directory?

Leave us a comment!